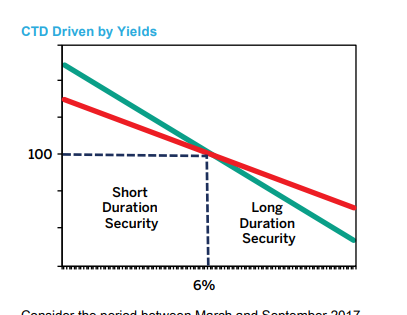

#Hedge trading is an institutional grade technique (for example bond market traders use TU Futures VS TY futures to hedge risks within the US10-US2 yields) and this is a powerful technique that can be applied in #cryptocurrency markets as long as you are aware of DXY symmetry and beta coefficients of the US500 to BTC and are able to use correct fibonacci sequencing and time series dialysis risk models

In a brief article, I outline how this is possible

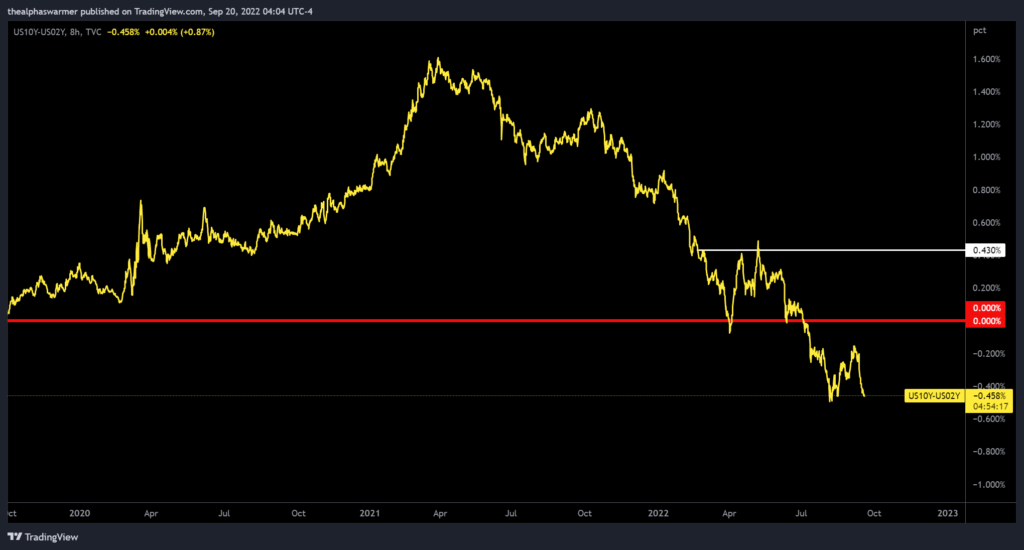

Firstly, the US10 yields were creeping up and hit an area of interest against the US2. This spread turned negative form June onwards and prior to this, trading TU vs TY futures in IB markets was an option to

In the below TWO charts, I map the zones of where yields were likely to react and took appropriate action on the US10-US2Y which is evident!

Whomever said that hedge trading is guess work needs to understand how hedge trading works! CME group publishes a user friendly article for beginners here!