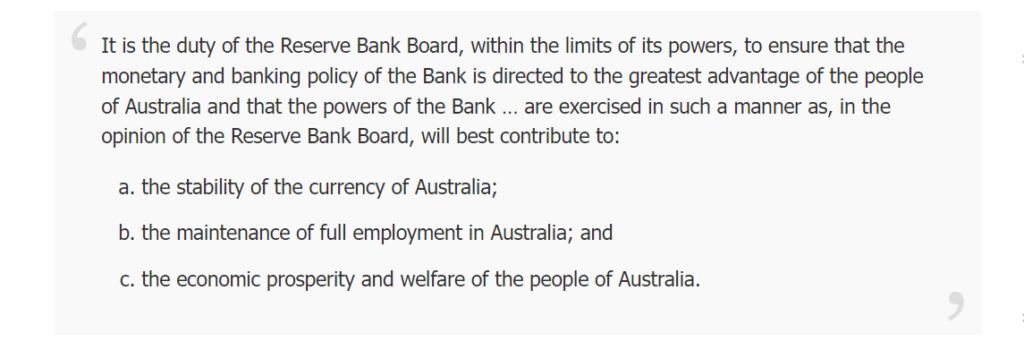

The notion of fiduciary duty is a core tenet of the CFA charter and underpins the regulatory paradigm across financial markets globally for it is the duty of the financial police and equivalent to ensure stability and transparency in economic systems. Every regulatory institution has a charter or mandate which is all about promoting things like price stability, containing inflation and other thematic that aim to smoothe and/or refactor out the components of aggregate demand and supply (now if you do not know about these concepts, you need to, for they are the core levers of economics). For simplicity, in the Australian context, the Reserve Bank of Australia articulates their charter as such (i am including a screenshot below of this)

However, given the current environment of rapid appreciation of the treasuries amidst what is effectively and environment of monetary policy convergence (opposed to divergence prior to the pandemic) – it is my view that all these tools of monetary policy is more blunt than ever. You see, monetary policy has transmission lags and this is being heavily debated by the likes of CNBC and Bloomy commentators alike. I mean the other day I read a mind-blowing article on Seeking Alpha which by Sir Andreas Cardinal (CFA) entitled “The Big questions After The Fed Meeting” wherein he bought to my attention the Hawkish Dot Plot which depicts visually the “expectations of different Fed officials about the future path of interest rates”, another form of “guesstimating” what we already know is a hawkish undertone amidst trepidations in economies globally.

The average transmission lag is twenty-nine months, and the maximum decrease in prices reaches 0.9 percent on average after a 1-percentage-point hike in the policy rate. Transmission lags are longer in developed economies (twenty-five to fifty months) than in post-transition economies (ten to twenty months).

Source: December 2013 issue contents

Transmission Lags of Monetary Policy: A Meta-Analysis https://www.ijcb.org/journal/ijcb13q4a2.htm#:~:text=The%20average%20transmission%20lag%20is,(ten%20to%20twenty%20months).

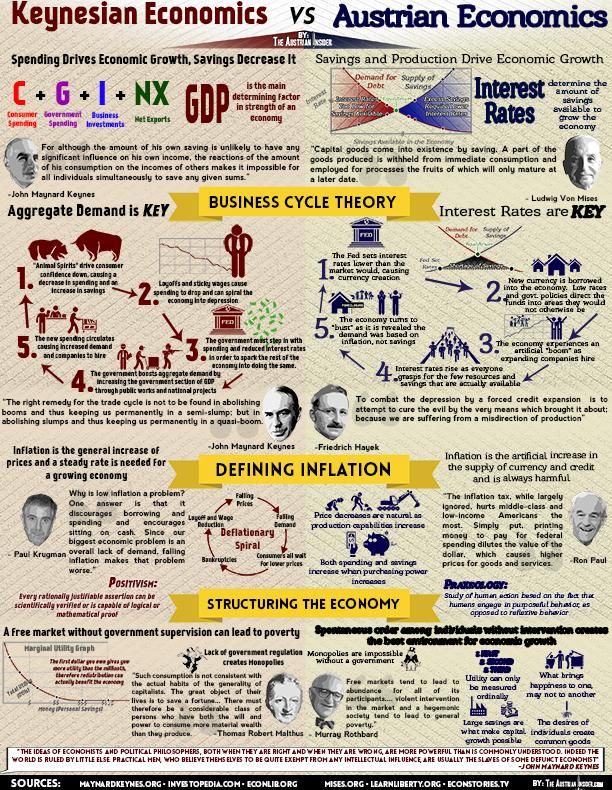

As such, the outlooks put forward by the Fed of which you can check out on the Fedwatch tool is all heresay and only representing a set of probabilities and opportunity sets and isnt the way to go as you need to be thematic in your approach in analysing systems. This kind of guesstimating by the FED is atrocious because we all know that the Federal Reserve has a horrible track record of predicting the future path of interest rates and given the autonomous and transmission lags inherent through its transmission. In this context, I cannot resist the urge to bring this to your attention (embedded below – for it is relevant)

When you think about it, all of this points to a bleak outlook for the immediate future. Yield appreciation and inversions are instantly reflected into price to earnings multiples and forward guidance’s that are used as the basis of discounting stonks on the #US500 index, which is heavy stuff and its movement and price action has repercussions across all markets (the contagion effect). Academics call this the efficient market hypothesis – a very powerful academic framework but one that is also becoming more prominent amidst the constant stream of information flows and ebbs in the likes of FinTwitter (some of which is good but most of which is all noise and garbage). I cover part of this in one of my pinned tweets and identify which parts are relevant and appropriate in the context of todays emerging knowledge economy (for ease of reference it is embedded below).

You see, I have been watching the US02 and US10 for some time now and within some zones of which I will share my chart below. I like to follow the chart yes, but I also like to understand themes and follow them, because it is in themes that you appreciate the tenets of self-evolving systems! This is the way to understand complex correlations and associations between finance and economics. I call this integrative tech-funda anlaysis of the exquisite nature. Why is this importnat? Because you need to understand the forces at play in network economies – period (a tabulated summary of which I include below a the end).

At the end of the day, my point is that the force of transparency is one that cannot be negated anymore. Even Ray Dalio was digging into the Fed as per this video? So what is the solution? In my view the solution is a new economic tool, blending monetary policy with fiscal policy to fix supply and demand side forces that are often operating divergently. Geopolitical risk and contagion is not cool either.

I covered this idea in my previous article entitled Yearning For More Economic Policy Innovation! Monetary Policy Is A Blunt Tool Of The past – Focus On The Future – here https://www.thealphaswarmer.com/2019/06/yearning-for-more-economic-policy-innovation-monetary-policy-is-a-blunt-tool-of-the-past-focus-on-the-future/

Do note that in that article, we were in a different economic context, so do read it with a pinch of salt and be amongst the few whom are able to connect the dots! Perhaps the wallstreet bets culture is one that is rife to explode here. Time tells all, the truth always comes out in the universe regardless of the sinister intentions of bad agents! Very few understand this!

GMT 0548+10 250922 – TO BE CONTINUED!