I previously wrote about the fallacies of the US dollar and why its death is inevitable to which I received very vocal counter-arguments on Twitter, friends, family members etc about its role as a “reserve currency”. Growing up, I venerated America as an ideal land of opportunity – as quoted by late grandfather – and often fantasised about travel and work there in the pursuit of my ever ending goals towards happiness. It is however now clear amidst the context of economic perturbations, asset class dislocations and geopolitical powerplays that America is in big trouble – and so is every other nation – and it is only getting started!

The shockwaves across financial markets fueled by geopolitical power plays have questioned the fundamental correlations that dominated valuations and the tenets of behavioural finance, investment models and technical analysis. Investors have abandoned traditional safe heaven assets such as the US dollar and migrated completely to physical stores of value such as gold, the Japanese Yen, the Euro and Swiss Franc. Market participants are trepidatious as they scramble to reprice risk through the lens of archaic financial models which are ironically part of the problems that pervade the financial landscape today. This argument is valid because the fundamental notion of investments centers on this concept of the risk free rate, or treasuries for example. Treasuries are meant to be a guarantee that governments will not default on their debt, yet, the Federal Reserve is amidst one of the global entities that hold the highest amount of debt, proven categorically through the debt clock which is traceable entirely online and one of which is often referenced in the tapestry of banter that permeate niche investment circles on the internet. Evidently, treasuries are no longer functioning the way they should – evident through their wild swings and trading activities over the last week as if they are risk assets or a cryptocurrency shit coin. True, it is often safer to park your monies with governments as the old school tendency is to trust in the government whom cannot go bankrupt – but this assumption will be challenged going forward as treasuries can not compete in the emerging networked economy. The argument I am raising here is that even the notion of risk free treasuries is being challenged – so what else is on the horizon?

Without doubt the USA is finished, the economy is showing palpable signs of slowing down. I was listening to a prominent hedge fund manager being asked about his take on consumptions wherein he mentioned simply ask your neighbour – a department store – and see how prices are being put on discount with the intention of inducing consumption. Remember, consumers are sovereign and with them consuming, the aggregate demand multiplier acts as a transmission mechanisms to other sectors, changing the elasticities of supply and invoking dynamic allocation of scare resources by service and product manufacturers. So if consumption is stalling, how is America booming? Or about to boom? It wont – they will face a severe economic crisis which is why Donald Trump is trying to be preemptive to protect reputations through the interplays of tariffs. Does he forget that America imports more than it exports to China and that China can truly induce excessive import inflation through reciprocal efforts that would distort consumer purchasing powers and in fact, cause more inflation!

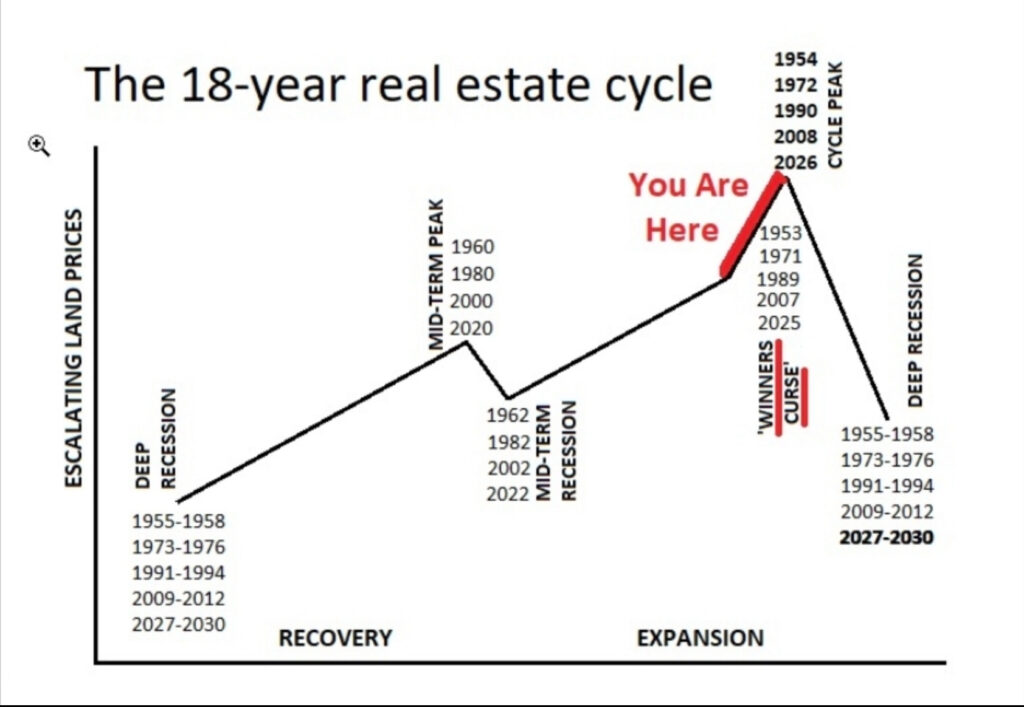

It is inflation that is the biggest problem not only in America, but this world. It inhibits the purchasing power of your real income and now the US is clearly failing in it’s fight for inflation, with a risk towards stagflation looming! The federal reserve is faced with one of its biggest dilemmas in history! Powell showed his hand in the past by labelling Quantitivate Easing as transitory – yet his comments at the recent FOMC alluded to inflation impact of tariffs as being transitory? True, tariffs are temporal deprecators as global trade then refactors and leverages the principals of comparative advantage (India taking over semi conductor manufacturing for example opposed to Taiwan and China and garment apparel production going to Latin America countries or even the South Pacific). Tariffs, however, if persistent will skew and disrupt the entire supply chain across economies and this would lead to significant non value added activities in product and service value chains. Multinational corporations will be hunting for innovations to ignite the consumption contexts to alleviate the diminishing returns from existing product and service lines. The repercussions of these economic games are far reaching – with impact to third world countries being significant. A global poverty spell can be casted on various nations which will be an implicit dominoe effect of supply chain de-rationalisation and aggressive retaliation of detriments to the notion of free trade. A global property downturn will ensue, fueled by excessive supply. The Middle East and Dubai for example, wil be the catalyst for over there – investors are so euphoric that they often flip properties off the plan within hours in the absence of any tangible backing. What will happen if global weather conditions worsen and polarise to such a degree that the Middle East starts to get monsoon like rainfall? Their system, will not be able to cope! Remember, I wrote about how important climate change is for the Australian Institute of Business’s journal (here) and negating this theme will invite nothing by chaos!

Lastly – due to my limited time and interest here to further argue my views – we are in a global economic crisis. The insights elucidated in this article, can not be negated.We are amidst trepidatious times with the cataclysmic signals that are pointing to a prolonged recession coupled with inflationary and deflationary divergence and the imminent national sovereign debt crisis. The US interest servicing ratio exceeds that of the department of defence’s budget and money printing only exacerbates the problem that fractional banking presents in my view!

In an effort to counter these forces that are detractors in the progression of gross domestic product and other leading an/or lagging indicators a new economic tool is required, one that specifically as I asserted in this article.

There is no other solution but to adopt a framework for innovation across all domains of government, business, enterprise and economies. The solution may very well be to forget , borrow and learn key lessons from history and fuse it with a mindset – the business model – that is delineated here. I will surely extend on this – this is Sunday prose free writing thoughts and some appreciative insights – nothing else!